Pakistan’s stocks performed 1.5% better this week

The Pakistan Stock Exchange (PSX) benchmark index KSE-100 moved up 1.5% during the week to close at 33,939 points.

During the week, the State Bank announced a 1% rate cut as the policy rate has been reduced to 7%. Overall, 6.25% has been reduced during 2020 so far.

Meanwhile, the SBP also confirmed receiving $1 billion from the ADB and World Bank, which has also stabilized the Pakistani rupee.

However, the government announced an increase in oil prices Friday night, which may make oil stocks interesting but also trigger inflation, which might affect other stocks differently.

Research analysts don’t think the increase in oil prices will have a significant impact on stocks in the coming week as overall oil consumption is already less due to the ongoing COVID-19 pandemic.

Analysts think that oil marketing companies may benefit on inventory after the price increase but the market was already expecting this so no significant movement can be expected.

Demand is weak as people are spending cautiously or are holding their investments due to the COVID-19 crisis so stocks are also not responding much to news of the policy rate cut, oil price increase or updates. In normal circumstances such news would trigger stocks to move up or down.

Related News

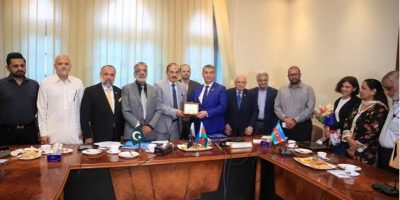

AZAL’s direct flights usher in new era of connectivity between Azerbaijan, Pakistan

KARACHI, APR 19 /DNA/ – The Ambassador of the Republic of Azerbaijan to the IslamicRead More

China Exports Drop More Than Expected in Setback to Recovery

Islamabad, Apr 12 (DNA): Experts lauded China’s role in advancing Hybrid Rice cultivation in Pakistan,Read More

Comments are Closed