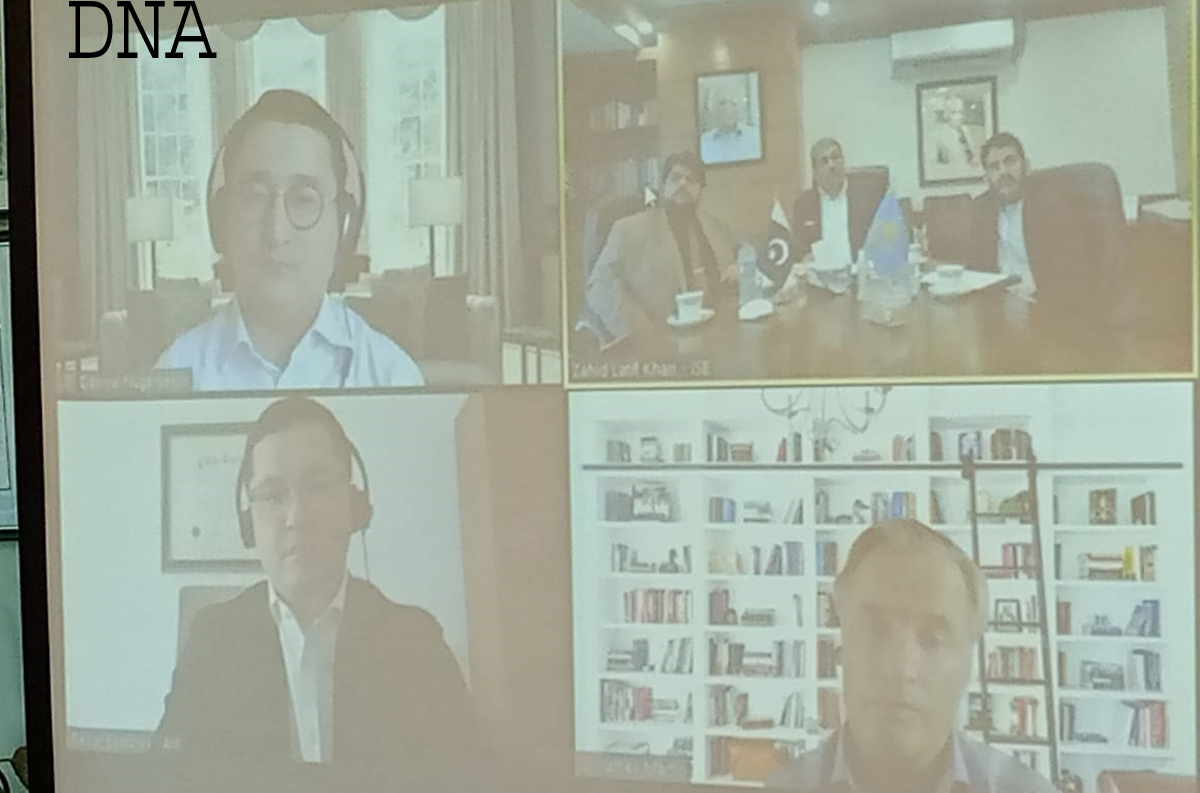

Pakistan, Kazakhstan businessmen mull over joint cooperation

Zahid Latif Khan briefs Kazakh counterparts abut Pakistan’s

potential; both sides agree to sign MoU

Shujat Hamza/DNA

ISLAMABAD: Meeting between representatives of AIFC, AIE Kazakhstan and Representatives of ISE RME and PSX, Pakistan in Islamabad. Zahid Latif Khan Chairman ISE Towers REIT Management Co. (ISE RMC), Vice Chairman Pakistan Stock Exchange Broker Association, Chairman Zahid Latif Khan Securities, Corporate Brokerage Firm PSX welcomed the participants.

Mr. James Martin, CEO of Astana International Financial Centre (AIFC) Business Connect (the business development arm of AIFC), Mr. Renat Bekturov CFO of the Astana International Exchange (AIE), Mr. Sagheer Mushtaq Chief Executive Officer, ISE Towers REIT Management Company (ISE RMC) formerly Islamabad Stock Exchange , Mr. Asghar Abbas Regional Head – Pakistan Stock Exchange (PSX) also attended the meeting.

He apprised that ISE RMC was formerly operating as Islamabad Stock Exchange. Consequent upon integration of all the three stock exchanges in Pakistan, ISE RMC granted the license to launch REIT Schemes. On the other side, PSX has been expanding and it is one of the best performing market in the region. Both the institutions have rich experience of capital market and ISE RMC / PSX platform can be useful to tap the businesses in Pakistan. Reciprocally, business community of Kazakhstan can also avail business potential in Pakistan.

AIFC and AIE representatives briefed that AIFC has been established on the international standards / laws with the objective to attract foreign investment and to provide business friendly environment. Already a number of UK / Europe based companies are listed on AIE, side by side foreign brokerage firms have also their respective business setup. AIFC also interested to invite investment from Asia region.

Participants of the meeting after discussion agreed to extend mutual cooperation initially in following major areas: Cross border listings on securities exchange; Establishment of brokerage business – cross border; to explore avenues for investment under REIT umbrella; Sharing of expertise relating to capital market.

Participants also agreed to sign the Memorandum of Understanding soon to formalize the arrangement.

Related News

RCCI hails $3.4bn Pak-Uzbek business deals as milestone

ISLAMABAD, FEB 6 /DNA/ – Strengthening bilateral economic ties, Pakistan and Uzbekistan have taken aRead More

ICCI hosts Uzbek delegation for talks on Fruit exports, joint ventures

ISLAMABAD, FEB 6 /DNA/ – President Islamabad Chamber of Commerce and Industry (ICCI), Sardar TahirRead More

Comments are Closed