Resilient China is firewall in emerging currency crisis

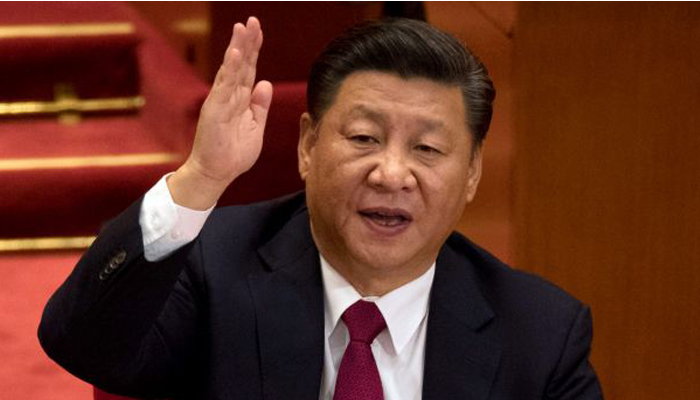

PARIS: (DNA) – China is the last bulwark against a deep crisis in emerging economies going fully global, analysts say, although a prolonged trade war could sap Beijing´s defences.

Emerging countries — loosely defined as having fast growing but volatile economies — have seen their currencies battered in recent weeks, plunging their finances into turmoil, and raising fears of global contagion.

But China, the world´s second-biggest economy and itself categorized as an emerging market, doesn´t share a key downside of the worst-hit countries: their rampant current account deficits.

“The possibility of a currency crisis in China is unlikely,” said Guan Qingyou, chief economist at China´s Rushi Advanced Institute of Finance.

“China´s ability to resist risk is relatively strong.”

‘Nail in coffin’

Current account deficits must be financed with foreign currencies, and as central banks across the world enter a cycle of tighter monetary conditions, especially the powerful US Federal Reserve, cheap money will become scarce.

Higher US interest rates are “another nail in the coffin” for emerging countries needing external financing, said Lukman Otunuga, a research analyst at FXTM.

A meltdown of the Turkish lira — somewhat stemmed by a recent massive interest rate rise — and the Argentinian peso are cases in point, as both countries have “exceptionally large current account deficits”, said Oliver Jones, markets economist at Capital Economics.

South Africa, Colombia and, to a lesser extent, India and Indonesia are in similar danger of being trapped in Fed rate rise pain, he said.

But the currencies of Korea, Thailand and Malaysia have done much better because of their close trade ties with Beijing and their healthier current account positions.

Related News

Netanyahu’s political future at stake with Iran war: experts

With elections approaching in Israel, the war with Iran has handed Prime Minister Benjamin NetanyahuRead More

Uzbekistan’s foreign trade turnover reaches $5.8 billion in January

TASHKENT, Mar 3: According to the National Statistics Committee, Uzbekistan’s foreign trade turnover totaled $5.8Read More

Comments are Closed