Administrative measures are necessary to reduce inflation

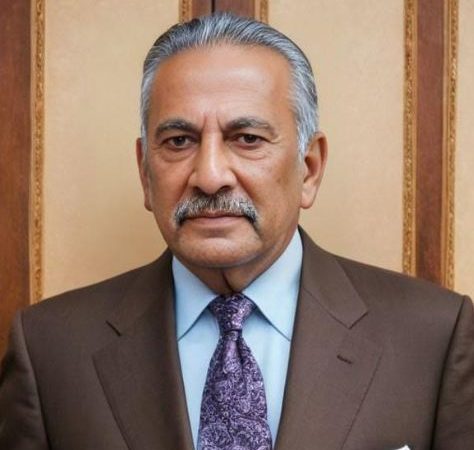

ISLAMABAD, MAY 3 /DNA/ – Shahid Rasheed Butt, who had previously served as the President of the Islamabad Chamber of Commerce and Industry (ICCI), stated on Friday that it is possible to bring assistance to the business community by lowering lending rates by a small amount.

The government and the masses are also being negatively impacted by the high interest rates. Therefore, the central bank should modify the policy rates during its subsequent meeting, he said,

In a statement released here today, Shahid Rasheed Butt stated that the SBP is exercising reluctance because it believes that loosening monetary policy will hasten the outflow of capital, raise the amount of pressure on the exchange, and enhance inflation which is already very high.

He said that the country is experiencing a decline in inflation; however, the inflation rate is thirteen percent greater than the objective set by the State Bank, which means that it cannot be handled just by implementing monetary policy.

In order to combat inflation, he stated that administrative measures against hoarders and profiteers, as well as essential changes, are the necessary measures.

The business leader said that Pakistan had joined the top ten countries regarding inflation, where inflation is five times higher than India and twice higher than Bangladesh.

Shahid Rasheed Butt said that inflation has made it impossible for people to live with peace of mind. Expenditures are increasing, but incomes are stagnant.

Moreover, he said that inflation could be reduced if there is a reduction in the price of electricity, gas, and oil, which will make it easier for the central bank to lower interest rates.

He noted that the central bank kept the key interest rate steady at 22% for the seventh straight meeting a few days ago, which disappointed businessmen.

SBP noted that macroeconomic stabilization measures contribute to considerable improvement in inflation and external position amidst moderate economic recovery.

The upcoming budgetary measures may affect the outlook for near-term inflation. The bankers stressed continuing the current monetary policy stance to bring inflation down to the target range by September 2025.

Besides the coordinated tight monetary and fiscal policy response, other factors that have led to this favorable outcome include lower global commodity prices and improved food supplies.

He said that with the IMF stressing the necessity for continuous economic adjustments and Pakistan facing substantial debt repayments of $24 billion in the upcoming fiscal year, the SBP is poised to maintain a cautious policy stance.

It may be mentioned that amid uncertainty regarding the inflation outlook, key central banks in advanced and emerging economies have maintained a cautious monetary policy stance.

Related News

Govt forms medical panel for Imran Khan’s examination

ISLAMABAD, FEB 15: The government has constituted a medical panel for the examination of PakistanRead More

Recovery of cash amounting to 5.3 million – Motorway Police sets example of integrity

IG NHMP, Addl. IG announce reward for concerned officers ISLAMABAD, FEB 15 /DNA/ – NationalRead More

Comments are Closed